PREIT Reports Second Quarter 2023 Results

Core Mall Total Occupancy Grew to 94.2%, Portfolio 95.0% Leased

Core Mall Sales Per Square Foot Were $592 in June

Average Renewal Spreads Were 4.7% for the Quarter Ended June 30, 2023

PREIT (OTCQB:PRET) today reported results for the three and six months ended June 30, 2023. A description of each non-GAAP financial measure and the related reconciliation to the comparable GAAP financial measure is provided in the tables accompanying this release.

“Our quarterly results demonstrate that our portfolio continues to be attractive to tenants and customers with core mall non-anchor occupancy improving 120 basis points and total leasing activity nearly 60% ahead of last year,” said Joseph F. Coradino, Chairman and CEO of PREIT. “Improvements in occupancy and renewal spreads are clear indicators of compelling nature of our portfolio to tenants.”

- Same Store NOI, excluding lease termination revenue, decreased 3.4% and decreased 2.2% when excluding Whole Foods at Plymouth Meeting for the three months ended June 30, 2023 compared to the three months ended June 30, 2022.

- Robust leasing activity is driving increased occupancy with Core Mall Total Occupancy increasing by 40 basis points to 94.2% compared to the second quarter 2022. Core Mall non-anchor Occupancy improved 70 basis points to 91.2% compared to the second quarter 2022.

- Core Mall total leased space, at 95.0%, exceeds occupied space by 80 basis points, and Core Mall non-anchor leased space, at 92.4%, is higher than occupied space by 120 basis points when including executed new leases slated for future occupancy, demonstrating the rapid pace of leasing activity.

- For the rolling 12 month period ended June 30, 2023, Core Mall comparable sales were $592 per square foot, compared to $539 for the year ended December 31, 2019.

- Average renewal spreads for the three and six months ended June 30, 2023 were 4.7% and 5.1%, respectively.

- Since the beginning of 2023, the Company sold assets generating just over $30 million in gross proceeds.

Leasing and Redevelopment

- 216,000 square feet of leases are signed for future openings, which is expected to contribute annualized gross rent of approximately $6.15 million.

- Construction is underway on the new self-storage facility in previously unused, below grade space at Mall at Prince George’s with an anticipated opening in the third quarter of 2023.

- Tilted 10 opened Phase II of its planned two-level indoor family entertainment center at Willow Grove Park in July 2023, adding family entertainment to this locally-loved destination shopping experience.

- At Moorestown Mall, construction is underway for the new state-of-the-art Cooper University Healthcare facility, expected to open its initial phase in fall 2023, and the 375-unit Pearl apartment development, following completion of the sale of land in the second quarter of 2022.

- At Springfield Town Center, tenant construction is underway for a new prototype, 32,000 square foot, LEGO® Discovery Center with an announced grand opening of August 9, 2023. Construction on the new 30,000 square foot Burlington location is also underway for an anticipated opening later this year. Municipal approvals were obtained for the development of 460 apartments and a 165-room hotel, setting the stage for sale of these parcels in the second half of 2023.

Primary Factors Affecting Financial Results for the Three Months Ended June 30, 2023 and 2022

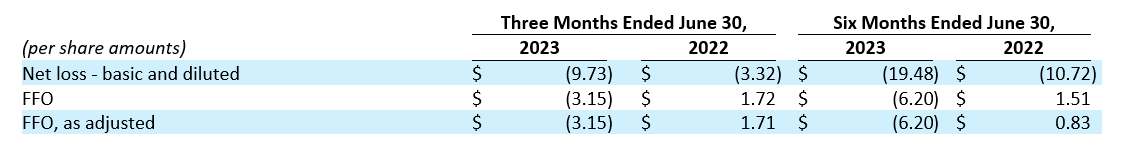

- Net loss attributable to PREIT common shareholders was $51.8 million (which takes into consideration the accrual of preferred dividends that accumulated during the quarter but have not been paid), or $(9.73) per basic and diluted share for the three months ended June 30, 2023, compared to net loss attributable to PREIT common shareholders of $17.6 million, or $(3.32) per basic and diluted share for the three months ended June 30, 2022.

- Funds from Operations decreased in the three months ended June 30, 2023 compared to the prior year period primarily due to higher interest expense and a decrease in gain on sale of equity method investment.

- FFO for the three months ended June 30, 2023 was $(3.15) per diluted share and OP Unit compared to $1.72 per diluted share and OP Unit for the three months ended June 30, 2022.

All NOI and FFO amounts referenced as primary factors affecting financial results above include our share of unconsolidated properties’ revenues and expenses. Additional information regarding changes in operating results for the three and six months ended June 30, 2023 and 2022 is included on page 15.

Liquidity and Financing Activities

As of June 30, 2023, the Company had $102.5 million available under its First Lien Revolving Credit Facility. The Company’s corporate cash balances, when combined with available credit, provide total liquidity of $110.7 million. The Company’s Credit Facilities, with a balance of $1,023.1 million as of June 30, 2023, mature on December 10, 2023. The Company is working to address the upcoming maturity by pursuing all available alternatives, including refinancing, selling assets and engaging in discussions with lenders.

During the quarter, the Company extended the mortgage loan secured by Cherry Hill Mall through December 1, 2023 with an additional five month extension option exercisable subject to satisfaction of certain conditions. The Company also extended the maturity date on the mortgage loan secured by Woodland Mall through October 5, 2023.

Asset Dispositions

During the quarter, the Company closed on the sale of a land parcel to Main Event at Woodland Mall for $4.8 million.

2023 Outlook

The Company is not issuing detailed guidance at this time.

Conference Call Information

Management has scheduled a conference call for 11:00 a.m. Eastern Time on Thursday August 3, 2023, to review the Company’s results and future outlook. To listen to the call, please dial 1(888) 330-2024 (domestic toll free), or 1(646) 960-0187 (international), and request to join the PREIT call, Conference ID 9326912, at least fifteen minutes before the scheduled start time as callers could experience delays. Investors can also access the call in a “listen only” mode via the internet at the Company’s website, preit.com. Please allow extra time prior to the call to visit the site and download the necessary software to listen to the Internet broadcast. Financial and statistical information expected to be discussed on the call will also be available on the Company’s website.

For interested individuals unable to join the conference call, the online archive of the webcast will also be available for one year following the call.

About PREIT

PREIT (OTCQB:PRET) is a publicly traded real estate investment trust that owns and manages innovative properties developed to be thoughtful, community-centric hubs. PREIT’s robust portfolio of carefully curated, ever-evolving properties generates success for its tenants and meaningful impact for the communities it serves by keenly focusing on five core areas of established and emerging opportunity: multi-family & hotel, health & tech, retail, essentials & grocery and experiential. Located primarily in densely-populated regions, PREIT is a top operator of high quality, purposeful places that serve as one-stop destinations for customers to shop, dine, play and stay. Additional information is available at www.preit.com or on Twitter, Instagram or LinkedIn.