PREIT Reports First Quarter 2022 Results

Core Mall Sales Per Square Foot Reach $613 in March, up from $603 at Year End

Strong Leasing Activity Resulted in Core Mall Leased Space at 94.0%

Asset Sales in Process Increased to $275 Million

PREIT (NYSE: PEI) today reported results for the three months ended March 31, 2022. A description of each non-GAAP financial measure and the related reconciliation to the comparable GAAP financial measure is provided in the tables accompanying this release.

“Our portfolio of assets continues to draw interest from investors and tenants interested in assets and parcels. We continue to focus on executing on the near-term plan to exercise our credit facility extension and our longer-term plan to improve our balance sheet through land and asset sales, ” said Joseph F. Coradino, Chairman and CEO of PREIT. “The team’s attention is on executing on our plan to improve our portfolio valuation through strong leasing and operating results and our capital position through asset sales. This quarter’s performance demonstrates the proficiency of our team, driving strong net operating income results and an increase in transactions in process to $275 million based on growing interest.”

- Same Store NOI, excluding lease termination revenue, increased 16.0% for the three months ended March 31, 2022 compared to the three months ended March 31, 2021.

- For the quarter, results were primarily impacted by a strong leasing and sales environment resulting in increased rent, percentage rent, percent sales and common area revenue of $3.5 million, and a decrease in credit losses for challenged tenants of $2.1 million compared to the three months ended March, 31, 2021.

- Robust leasing activity is driving increased occupancy with Core Mall Total Occupancy increasing by 500 basis points to 92.7% compared to the first quarter 2021. Core Mall Non-anchor Occupancy increased 290 basis points, sequentially, to 88.8%.

- Total Core Mall leased space, at 94.0%, exceeds occupied space by 130 basis points, and core mall non-anchor leased space, at 90.7%, exceeds occupied space by 190 basis points when including executed new leases slated for future occupancy, demonstrating the rapid pace of leasing activity.

- For the rolling 12 month period ended March 31, 2022, core mall comparable sales grew by 18.6% to $613 per square foot.

- Average renewal spreads for the three months ended March 31, 2022 improved to 3.7%. Sequentially, average renewal spreads for tenants less than 10,000 square feet improved from (11.0%) for the quarter ended December 31, 2021 to 3.8% for the quarter ended March 31, 2022.

- The Company made notable advances in its capital-raising efforts and is now underway with $275 million in transactions and anticipates closing approximately $109 million in sales prior to June 30, 2022.

Leasing and Redevelopment

- 408,000 square feet of leases are signed for future openings, which is expected to contribute annualized gross rent of $6.8 million.

- Leasing momentum continues to build with transactions executed for 203,000 square feet of occupancy thus far in 2022.

- Construction is expected to begin this year on a new self-storage facility in previously unused below-grade space at Mall at Prince George’s in Hyattsville, MD.

- A lease has been executed with Tilted 10 and Tilt Studio, an action-packed bi-level 104,000 square foot indoor family entertainment center at Willow Grove Park, adding family entertainment to this locally-loved destination shopping experience, and is expected to open in the third quarter 2022.

- Phoenix Theatres at Woodland Mall, occupying 47,000 square feet, opened in April 2022.

- HomeGoods at Cumberland Mall opened in March 2022 occupying 23,000 square feet.

- Landlord work is underway for a new prototype, 32,000 square foot, LEGO® Discovery Center at Springfield Town Center with expected opening in third quarter 2023.

- New-to-portfolio tenants have been executed at Cherry Hill Mall for occupancy in 2022: Marc Cain and Warby Parker are now open and Eddie V’s Prime Seafood is expected to open later this year.

Primary Factors Affecting Financial Results for the Three Months Ended March 31, 2022 and 2021

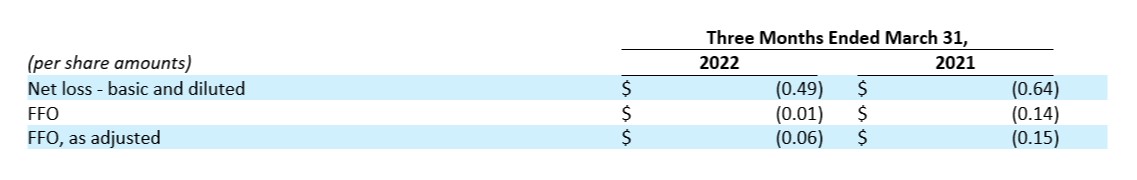

- Net loss attributable to PREIT common shareholders was $39.3 million (which takes into consideration the accrual of preferred dividends that accumulated during the quarter but have not been paid), or $0.49 per basic and diluted share for the three months ended March 31, 2022, compared to net loss attributable to PREIT common shareholders of $49.6 million, or $0.64 per basic and diluted share for the three months ended March 31, 2021.

- Funds from Operations showed significant improvement over the quarter ended March 31, 2021 driven by increases in real estate revenue, a gain on sale of the preferred share interest resulting from the sale of our interest in land in New Garden, PA, reduced general and administrative and restructuring costs offset by a gain on hedge ineffectiveness that impacted the quarter ended March 31, 2021.

- Same Store NOI, including lease terminations, increased by $6.8 million, or 18.0%. The increase is primarily due to higher rent, percent sales, percentage rent and lease termination revenue, and decrease in credit losses as compared to the prior year.

- FFO for the three months ended March 31, 2022 was $(0.01) per diluted share and OP Unit compared to $(0.14) per diluted share and OP Unit for the three months ended March 31, 2021.

All NOI and FFO amounts referenced as primary factors affecting financial results above include our share of unconsolidated properties’ revenues and expenses. Additional information regarding changes in operating results for the three months ended March 31, 2022 and 2021 is included on page 15.

Liquidity and Financing Activities

As of March 31, 2022, the Company had $76.2 million available under its First Lien Revolving Credit Facility. The Company’s corporate cash balances, when combined with available credit, provide total liquidity of $110.5 million.

In March 2022, the mortgage loan secured by Gloucester Premium Outlets was extended for one year.

Asset Dispositions

Multifamily Land Parcels: The Company has executed agreements of sale for land parcels for anticipated multi-family development in the aggregate amount of $72.0 million. The agreements are with multiple buyers across four properties for over 1,800 units as part of the Company’s previously announced multi-family land sale plan. Of particular note, the transaction for the multi-family land sale at Exton Square Mall is factored into the asset sale price noted below. Closing on these transactions is subject to customary due diligence provisions and securing entitlements.

Hotel Parcels: The Company has an executed agreement of sale to convey a land parcel for anticipated hotel development in the amount of $2.5 million for approximately 125 rooms. The Company has an executed LOI for the sale of a parcel for hotel development at Springfield Town Center for $2.7 million. Closing on these transactions is subject to customary due diligence provisions and securing entitlements.

Other Parcels: In February, we completed the redemption of preferred equity issued as part of the sale of our New Garden land parcel. In connection with this settlement, we received approximately $2.5 million. The Company expects to close on the sale of an anchor box at Valley View Mall in the second quarter for $2.8 million. In March, the Company executed a purchase and sale agreement for the sale of Exton Square Mall for $27.5 million. In April, we executed a purchase and sale agreement for the sale of the former Sears TBA location at Moorestown Mall for $3.35 million.

2022 Outlook

The Company is not issuing detailed guidance at this time.

Conference Call Information

Management has scheduled a conference call for 11:00 a.m. Eastern Time on Thursday May 5, 2022, to review the Company’s results and future outlook. To listen to the call, please dial 1(844) 200-6205 (domestic toll free), or 1(646) 904-5544 (international), and request to join the PREIT call, Conference ID 949541, at least fifteen minutes before the scheduled start time as callers could experience delays. Investors can also access the call in a “listen only” mode via the internet at the Company’s website, preit.com. Please allow extra time prior to the call to visit the site and download the necessary software to listen to the Internet broadcast. Financial and statistical information expected to be discussed on the call will also be available on the Company’s website.

For interested individuals unable to join the conference call, the online archive of the webcast will also be available for one year following the call.