PREIT Reports Third Quarter 2023 Results

Core Mall Total Occupancy 93.6%, Portfolio 94.8% Leased

Average Renewal Spreads Were 8.5% for the Quarter Ended September 30, 2023

Philadelphia, November 14, 2023 – PREIT today reported results for the three and nine months ended September 30, 2023. A description of each non-GAAP financial measure and the related reconciliation to the comparable GAAP financial measure is provided in the tables accompanying this release.

“During the quarter, we welcomed new and diverse tenants across our portfolio and look forward to additional openings as we head into the holiday season,” said Joseph F. Coradino, Chairman and CEO of PREIT.

- Same Store NOI, excluding lease termination revenue, decreased 5.3% and decreased 4.1% when excluding Whole Foods at Plymouth Meeting for the three months ended September 30, 2023 compared to the three months ended September 30, 2022.

- Core Mall Total Occupancy decreased by 70 basis points to 93.6% compared to the third quarter 2022. Core Mall non-anchor Occupancy decreased by 100 basis points to 90.3% compared to the third quarter 2022, with the decrease driven largely by joint venture properties.

- Core Mall total leased space, at 94.8%, exceeds occupied space by 120 basis points, and Core Mall non-anchor leased space, at 92.1%, is higher than occupied space by 180 basis points when including executed new leases slated for future occupancy, demonstrating the rapid pace of leasing activity.

- For the rolling 12 month period ended September 30, 2023, Core Mall comparable sales were $585 per square foot, compared to $592 per square foot for the rolling 12 month period ended September 30, 2022.

- Average renewal spreads for the three and nine months ended September 30, 2023 were 8.5% and 5.5%, respectively.

- Since the beginning of 2023, the Company sold assets generating just over $30 million in gross proceeds.

Leasing and Redevelopment

- 186,000 square feet of leases are signed for future openings, which is expected to contribute annualized gross rent of approximately $5.62 million.

- The new self-storage facility in previously unused, below grade space at Mall at Prince George’s is now open.

- At Moorestown Mall, construction is underway for the new state-of-the-art Cooper University Healthcare facility, expected to open its initial phase in fall 2023, and the 375-unit Pearl apartment development, following completion of the sale of land in the second quarter of 2022.

- At Springfield Town Center, LEGO® Discovery Center celebrated its grand opening on August 9, 2023. Burlington opened its new 30,000 square foot location this past weekend. Municipal approvals were obtained for the development of 460 apartments and a 165-room hotel, setting the stage for sale of these parcels.

- Construction is underway for ULTA to open its new location at Dartmouth Mall this month.

Primary Factors Affecting Financial Results for the Three Months Ended September 30, 2023 and 2022

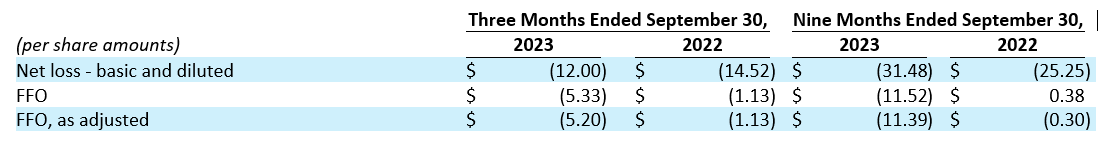

- Net loss attributable to PREIT common shareholders was $63.9 million (which takes into consideration the accrual of preferred dividends that accumulated during the quarter but have not been paid), or $(12.00) per basic and diluted share for the three months ended September 30, 2023, compared to net loss attributable to PREIT common shareholders of $77.2 million, or $(14.52) per basic and diluted share for the three months ended September 30, 2022.

- Funds from Operations decreased in the three months ended September 30, 2023 compared to the prior year period primarily due to higher interest expense.

- FFO for the three months ended September 30, 2023 was $(5.33) per diluted share and OP Unit compared to $(1.13) per diluted share and OP Unit for the three months ended September 30, 2022.

Liquidity and Financing Activities

As of September 30, 2023, the Company had $30.6 million available under its First Lien Revolving Credit Facility. The Company’s corporate cash balances, when combined with available credit, provide total liquidity of $38.6 million. The Company’s Credit Facilities, with a balance of $1,118.8 million as of September 30, 2023, mature on December 10, 2023. The Company, through its advisors, has engaged in discussions and negotiations with certain members of a lender group under its Credit Agreements with respect to a potential restructuring transaction. These discussions have included negotiations of the terms and conditions of a financial restructuring. Although the Company and the members of the lender group are working toward an agreement on certain terms and conditions of a restructuring, there can be no assurance that the parties will reach a binding agreement regarding terms of a restructuring in a timely manner, on terms that are attractive to the Company, or at all.

During the third quarter, the Company repaid the mortgage loan secured by Dartmouth Mall using funds from its First Lien Revolving Credit Facility.

2023 Outlook

The Company is not issuing detailed guidance at this time.

About PREIT

PREIT (OTCQB:PRET) is a publicly traded real estate investment trust that owns and manages innovative properties developed to be thoughtful, community-centric hubs. PREIT’s robust portfolio of carefully curated, ever-evolving properties generates success for its tenants and meaningful impact for the communities it serves by keenly focusing on five core areas of established and emerging opportunity: multi-family & hotel, health & tech, retail, essentials & grocery and experiential. Located primarily in densely-populated regions, PREIT is a top operator of high-quality, purposeful places that serve as one-stop destinations for customers to shop, dine, play, and stay. Additional information is available at www.preit.com or on Twitter, Instagram, or LinkedIn.