PREIT Reports Strong Sales and Holiday Traffic and Progress on Key Strategic Initiatives

Robust Holiday Shopper Traffic Resulted in October and November Monthly Sales Increase of 9.3% and 6.1%

Rolling 12-Month Portfolio Sales Per Square Foot Now Approaching $600

PREIT has Hired PJT Partners to Pursue Strategic and Financial Initiatives to Further Strengthen the Company’s Balance Sheet

PREIT (NYSE: PEI) (the “Company”), a leading real estate investment trust focused on creating thoughtful, community-centric properties, today announced meaningful increases in shopper traffic over the holiday season, building on strong sales during the early shopping season in October and November. PREIT also provided an update on its ongoing efforts to improve its financial position, including a process now underway to consider a wide range of options to reduce debt and strengthen the Company’s capital structure.

Joseph F. Coradino, Chairman and CEO of PREIT, said, “We are encouraged by the increased customer traffic and positive sales trends throughout the holiday season, which demonstrates continued momentum in the pace of recovery. Continued consumer confidence, coupled with our strong operational execution, position PREIT’s portfolio for success as we enter the new year.”

Robust Leasing Activity and Shopper Traffic over Holiday Season

Following years of strategic portfolio pruning and reinvestment of capital in proactive anchor repositioning, the strength of PREIT’s portfolio is evident in its 2021 leasing and tenant sales results.

In 2021, the Company executed transactions for 1.2 million square feet of new space – more than any of the past five years and nearly three times as much as 2019. This creates a strong foundation for the future, as PREIT begins 2022 with executed leases to come online during the year which is expected to generate $4 million of new revenue annually.

During 2021, over 1.1 million square feet of space opened throughout PREIT’s portfolio. Notable first-to-portfolio 2021 openings include:

- Aldi at Dartmouth Mall

- Miniso, Peloton and Purple at Cherry Hill Mall

- Power Warehouse at Cumberland Mall

- Turn 7 at Moorestown Mall

- Rose & Remington, Lovisa and Offline by aerie (opening this week) at Woodland Mall

Strong demand is driving improved results across PREIT’s portfolio. This is illustrated by existing tenant sales which, on a rolling 12-month basis through November, were up over five percent in the core portfolio compared to the rolling 12-month period ended November 30, 2019. Traffic during the holiday season (November and December) grew by 25% over 2020 at core malls with over 8 million customers visiting PREIT malls during that time. Anecdotally, retailers operating in the Company’s portfolio experienced strong sales throughout the season on the heels of a strong fall where sales for comparable tenants grew by 9.3% and 6.1% in October and November, respectively. Estimated core mall comparable sales per square foot reached a record high of $590 for the period ended November 30, 2021.

Capital-Raising Activity

Capital-raising, to reduce debt and the Company’s interest burden, remains a key focus of management. The Company’s capital plan includes raising over $350 million in multiple phases.

During its Q3 2021 earnings call, the Company outlined its intention to sell over 10 land and operating parcels for over $120 million in proceeds between now and the middle of 2022 as part of its initial phase of capital-raising, including approximately $40 million in multi-family land sales and $80 million in other parcel sales.

As the second phase of capital-raising, the Company has contracts for additional multi-family land sales for another $60 million and an additional phase of multi-family land sales estimated at $100 million in value. The Company is also marketing several other parcels for approximately $70 million. Capital raised will be used to reduce the Company’s outstanding debt.

Mr. Coradino continued, “Raising capital is a key strategic priority to further strengthen PREIT’s financial flexibility for the benefit of our stakeholders. We have several significant capital-raising initiatives in advanced stages of implementation and will continue to opportunistically reduce our overall debt and interest obligations. This holiday season highlighted the strength of our portfolio, which we expect will continue to solidify as new tenants and uses come online in 2022 and we execute on our balance sheet improvement initiatives.”

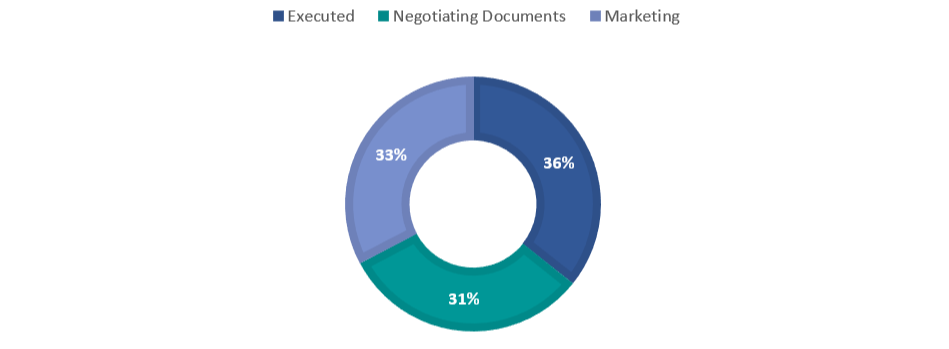

The status of Phase I initiatives, for $120 million in gross proceeds, can be found below. Over 67% is executed or in documentation.

Multi-family Land Sales

Closing on land parcels for multi-family development is an important way the Company is efficiently raising capital and further evolving its properties. PREIT is progressing on all facets of the announced projects and currently expects to close on three sales with a current contract value of approximately $40 million before June 30, 2022. Three additional sales are currently under contract for over $60 million and are expected to close before the end of 2023. A phase II multi-family opportunity is estimated to potentially raise an additional $100 million for over 2,000 units.

Evaluating Opportunities to Further Reduce Debt and Strengthen the Company’s Capital Structure

“Over the past several years, we have improved operational efficiency and drove stable and increasing cash flows from operations while advancing our portfolio. Today, our business is performing well, as most recently evidenced by a strong holiday season,” said Coradino. “While we are pleased with our progress to date, and look forward to reducing PREIT’s debt to position ourselves to exercise our credit facility extension option, we are undertaking a thorough review of our business and capital structure. Our Board and management team are evaluating a wide range of opportunities to further strengthen the Company’s balance sheet and financial flexibility.”

To assist the Board of Trustees and management team in pursuing strategic and financial options that will strengthen the Company’s balance sheet, PREIT has engaged PJT Partners, a premier global advisory-focused investment bank. There can be no assurance that the process will result in any particular outcome, and the Company notes that it will take the appropriate time to complete the review. PREIT does not intend to provide updates concerning this process until such time as the Company determines that further disclosure is necessary or appropriate.