PREIT Reports First Quarter 2023 Results

Core Mall Total Occupancy Grew to 93.5%

Core Mall Non-Anchor Occupancy Increased 150 Basis Points to 90.1%

Core Mall Sales Per Square Foot Were $603 in March, Growing 1.2% Over December 2022

Average Renewal Spreads Were 5.6% for the Quarter Ended March 31, 2023

Mortgage Loan on Cherry Hill Mall Extended

PREIT today reported results for the three months ended March 31, 2023. A description of each non-GAAP financial measure and the related reconciliation to the comparable GAAP financial measure is provided in the tables accompanying this release.

“Our quarterly results demonstrate the continued strength of the portfolio and the resiliency of the consumer as sales, occupancy and NOI continue to show improvement,” said Joseph F. Coradino, Chairman and CEO of PREIT. “While the economic backdrop is in flux, as we deliver new retailers and experiences throughout the portfolio, we expect to continue to drive traffic and sales, creating new opportunities to improve the value of portfolio.”

- Same Store NOI, excluding lease termination revenue, increased 5.7% for the three months ended March 31, 2023 compared to the three months ended March 31, 2022.

- Robust leasing activity is driving increased occupancy with Core Mall Total Occupancy increasing by 90 basis points to 93.5% compared to the first quarter 2022. Core Mall non-anchor Occupancy improved 150 basis points to 90.1% compared to the first quarter 2022.

- Core Mall total leased space, at 94.5%, exceeds occupied space by 100 basis points, and Core Mall non-anchor leased space, at 91.7%, is higher than occupied space by 160 basis points when including executed new leases slated for future occupancy, demonstrating the rapid pace of leasing activity.

- For the rolling 12 month period ended March 31, 2023, core mall comparable sales grew to $603 per square foot, compared to $539 for the year ended December 31, 2019.

- Average renewal spreads for the three months ended March 31, 2023 were 5.6%.

- Since the beginning of 2023, the Company sold assets generating just over $26 million in gross proceeds. As part of its debt reduction plan, the Company has applied asset sale proceeds and excess cash from operations to pay down debt by $29 million through March 31, 2023.

Leasing and Redevelopment

- 258,000 square feet of leases are signed for future openings, which is expected to contribute annualized gross rent of approximately $7.2 million.

- Construction is underway on the new self-storage facility in previously unused, below grade space at Mall at Prince George’s in Hyattsville, MD, with an anticipated opening in the third quarter of 2023.

- Tilted 10 opened Phase I of its planned two-level indoor family entertainment center at Willow Grove Park in March 2023, adding family entertainment to this locally-loved destination shopping experience. The balance of the facility is expected to open in summer 2023.

- At Moorestown Mall, construction is underway for the new state-of-the-art Cooper University Healthcare facility, expected to open its initial phase in fall 2023, and the 375-unit Pearl apartment development, following completion of the sale of land in the second quarter of 2022.

- Tenant construction is underway for a new prototype, 32,000 square foot, LEGO® Discovery Center at Springfield Town Center with expected opening in third quarter 2023. Burlington has also executed a lease for a 30,000 square foot location with an anticipated opening later this year. Approvals were obtained for the development of 460 apartments and a 165-room hotel, setting the stage for sale of these parcels in summer 2023.

Primary Factors Affecting Financial Results for the Three Months Ended March 31, 2023 and 2022

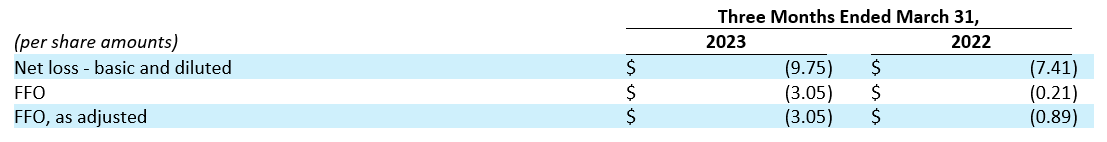

- Net loss attributable to PREIT common shareholders was $51.9 million (which takes into consideration the accrual of preferred dividends that accumulated during the quarter but have not been paid), or $(9.75) per basic and diluted share for the three months ended March 31, 2023, compared to net loss attributable to PREIT common shareholders of $39.3 million, or $(7.41) per basic and diluted share for the three months ended March 31, 2022.

- Funds from Operations decreased in the three months ended March 31, 2023 compared to the prior year period primarily due to higher interest expense and a decrease in gain on sale of preferred equity interest.

- FFO for the three months ended March 31, 2023 was $(3.05) per diluted share and OP Unit compared to $(0.21) per diluted share and OP Unit for the three months ended March 31, 2022.

All NOI and FFO amounts referenced as primary factors affecting financial results above include our share of unconsolidated properties’ revenues and expenses. Additional information regarding changes in operating results for the three months ended March 31, 2023 and 2022 is included on page 15.

Liquidity and Financing Activities

As of March 31, 2023, the Company had $107.5 million available under its First Lien Revolving Credit Facility. The Company’s corporate cash balances, when combined with available credit, provide total liquidity of $117.0 million. The Company’s Credit Facilities, with a balance of $995.8 million as of March 31, 2023, mature on December 10, 2023. The Company is working to address the upcoming maturity by pursuing all available alternatives, including refinancing, selling assets and engaging in discussions with lenders.

Additionally, the Fashion District Philadelphia partnership has extended the maturity on the term loan to January 2024.

Subsequent to the end of the quarter, the Company extended the mortgage loan secured by Cherry Hill Mall through December 1, 2023 with an additional five month extension option exercisable subject to satisfaction of certain conditions.

Asset Dispositions

During the quarter, the Company closed on the sale of its Whole Foods parcel at Plymouth Meeting Mall for $27 million.

2023 Outlook

The Company is not issuing detailed guidance at this time.

Conference Call Information

Management has scheduled a conference call for 11:00 a.m. Eastern Time on Thursday May 4, 2023, to review the Company’s results and future outlook. To listen to the call, please dial 1(888) 330-2024 (domestic toll free), or 1(646) 960-0187 (international), and request to join the PREIT call, Conference ID 913781768, at least fifteen minutes before the scheduled start time as callers could experience delays. Investors can also access the call in a “listen only” mode via the internet at the Company’s website, preit.com. Please allow extra time prior to the call to visit the site and download the necessary software to listen to the Internet broadcast. Financial and statistical information expected to be discussed on the call will also be available on the Company’s website.

For interested individuals unable to join the conference call, the online archive of the webcast will also be available for one year following the call.